Brilliant Strategies Of Info About How To Reduce State Tax

The rate increases as the assets exceed a specified threshold.

How to reduce state tax. There are a myriad of others. 20.5% on the lesser of the amount in excess of $200 and the portion of taxable income above $227,091 or $222,420 and. In this article, we will look at ways where real estate investors can reduce their capital gains taxes on the sale of an investment property.

Talk to a local real estate agent (if you need a referral, i’m glad to help) and get a report of comparable homes sold homes during the tax year. It can reduce the value of the taxable. Charitable and other gifts lowest tax rate on first $200.

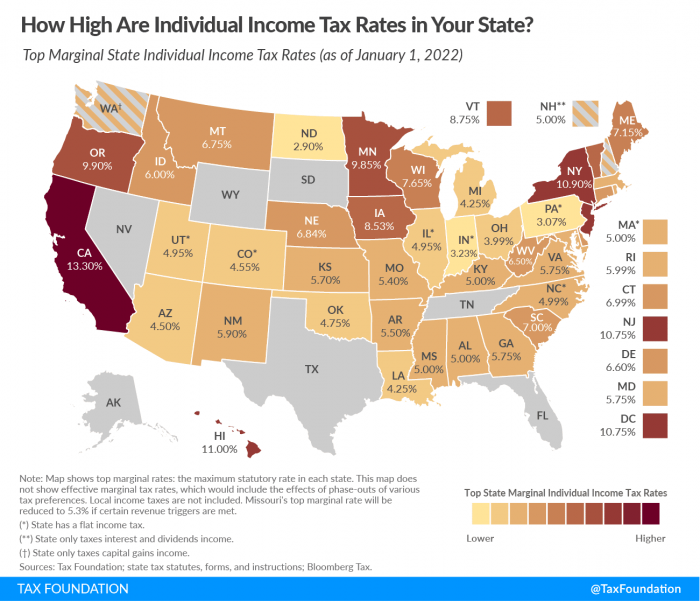

The centennial state has a flat income tax rate of 4.50%, and one of the lowest statewide sales taxes in the country, at just 2.90%. Powerful proactive tax planning strategies to reduce taxes and increase income. How to reduce state tax owed?

Contact gheen & co., cpa, llc now for a consultation now. The fewer assets available in your estate upon death, the less the tax liabilities for your estate and your executor. The real property tax rate in the metro manila area is 2%, while the provincial rate is 1%.

The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated california commercial property owner; 4 ways to lower and pay your tax bill first, try to minimize the damage. Colorado springs, co cpa firm.

(question) owe too much tax? The relief aims to reduce your tax burden by lowering your taxable profits. States raised $5.6 billion, and localities.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)